Railroaded: Made in USA by China

This write-up is a follow-up to Frederick R. Smith’s previous essay, Tainted Railroad Honey Pot. Here, we will focus on the China Railway Rolling Stock Corporation's USA operations.

Neither a wise man nor a brave man lies down on the tracks of history to wait for the train of the future to run over him.

Dwight D. Eisenhower

Words: 3,784 ~ Read time: 15 min

Introduction

This write-up is a follow-up to my previous essay, Tainted Railroad Honey Pot. Here, the focus concerns the China Railway Rolling Stock Corporation assembling transit and commuter rail rolling stock in the United States.

Executive Summary

This essay reviews China Railway Rolling Stock Corporation’s (CRRC) ventures in the United States. It focuses on contracts with significant transit authorities:

Chicago Transit Authority

Los Angeles County Metropolitan Transportation Authority

Massachusetts Bay Transportation Authority, and

Southeastern Pennsylvania Transportation Authority

These endeavors unfold against economic, geopolitical, and technical challenges. These contracts have a common thread. It’s the delicate interplay between economic cooperation and geopolitical tensions. The challenges faced by CRRC highlight the need to balance fostering international partnerships. They also need to safeguard national interests. The evolving economic relationship between the United States and China complicates these ventures. Concerns about data security and technology transfer also contribute to this complexity.

The essay laments the decline of domestically-owned passenger railcar manufacturing. It emphasizes the historical significance and repercussions of its demise. Foreign-owned companies dominate the production of passenger railcars for the U.S. common carrier and transit market. That creates economic challenges and compromises the nation’s self-reliance.

China Railway Rolling Stock Corporation

China Railway Rolling Stock Corporation (CRRC) is a Chinese-owned and traded enterprise. It specializes in the production of rolling stock. CRRC traces its roots back over 100 years to the Sifang Locomotive Works, which began in 1900 and is now the world’s largest builder of high-speed trains.

On June 1, 2015, China CNR Corporation and CSR Corporation Limited merged to establish CRRC. It became the world’s top rolling stock maker by revenue. It surpassed major rivals like Alstom and Siemens. With its headquarters situated in Beijing, China, CRRC boasts a workforce of over 183,000 employees. CRRC’s primary activities include research and development. They also design, manufacture, maintain, sell, lease, and provide technical services. They focus on rolling stock, urban rail transit vehicles, and engineering machinery. They also produce various electrical equipment, electronic devices, and related components.

CRRC has launched hiring and training initiatives. But, it has also faced criticism. People fear that a Chinese company could dominate the United States railcar industry. There are also concerns about China’s geopolitical ambitions. They want to get sensitive American technology through such ventures. CRRC has two subsidiaries in the United States - CRRC MA Corporation and CRRC Sifang America.

CRRC Sifang America

CRRC organized CRRC Sifang America as a subsidiary in 2010. The Chicago Transit Authority awarded CRRC Sifang America a contract in 2016 to supply 846 new railcars. In March 2017, CRRC Sifang America broke ground for a new factory on the southeast side of Chicago, and it started operating in the summer of 2019.

Construction on the Chicago General Assembly Plant started on March 16, 2017. The total “investment” was $100 million, and the plant covers 275 acres. The plant employs 169 factory and warehouse workers. The facility also provides training for its Chicago final assembly workforce.

CRRC MA

CRRC MA Corporation also is a subsidiary of CRRC. They established it in 2014, and it has its headquarters in Springfield, Massachusetts. It specializes in manufacturing rail cars. CRRC MA has supplied rail cars to Boston, Los Angeles, and Philadelphia transit agencies.

They built the $95 million factory on 40 acres of the former Westinghouse site. They assemble subway cars and commuter railcars for public transit systems across North America. It represented one of Massachusetts’s most significant Chinese investments at the time. The company’s motivation for locating in Springfield was due to the city’s long-lost history as a railcar production hub. The company was also motivated by the available workforce. Government officials from America and China attended the facility’s opening. They emphasized the “partnership” between the two countries.

The manufacturing facility in Massachusetts employs 179 employees, including 122 union production employees. Engineers, welders, electricians, and other technical specialists comprise the workforce.

The Customers

The CRRC customers in the United States include the Chicago Transit Authority, Los Angeles County Metropolitan Transportation Authority, Massachusetts Bay Transporation Authority, and Massachusetts Bay Transporation Authority.

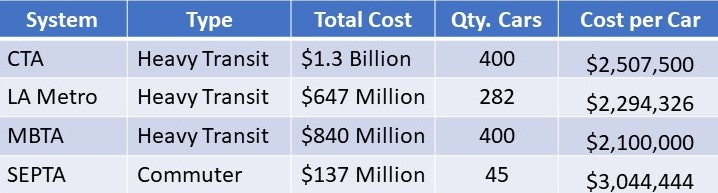

Chicago Transit Authority

In 2016, CRRC Sifang America clinched a $1.3 billion deal with the Chicago Transit Authority (CTA). They will manufacture 400 new railcars for the 7000-series. This contract significantly expanded CRRC’s presence in the United States public transportation sector.

The original task was to deliver ten prototype cars for testing by 2020. But, production came to a halt in 2019. The Trump administration imposed tariffs on specific Chinese goods. These goods include components for railway equipment. That affected the sourcing of parts for the 7000-series cars.

In 2021, the Biden administration issued an executive order. It called for increased scrutiny of foreign railway contracts. The goal is to identify potential national and economic security threats.1 The order did not mention Chinese manufacturers. But, it indicated a heightened cautiousness towards state-backed enterprises, such as CRRC. The CTA stated that they need to conduct more supply chain audits. They also need to put in place provisions for cyber monitoring.

By April 2021, the 10-car prototype fleet began testing at the CTA. In June 2022, CTA received the first more cars for revenue service. There has yet to be a published timeline for full-scale production or the delivery of the hundreds of vehicles promised years earlier.

Los Angeles County Metropolitan Transportation Authority

In March 2017, the Los Angeles County Metropolitan Transportation Authority (L.A. Metro) granted CRRC MA a $647 million contract. They will produce up to 282 new subway cars. That aligns with L.A. Metro’s initiative to modernize its infrastructure. It also aims to enhance mass transit throughout Los Angeles.

CRRC MA planned to present a prototype car by spring 2021. They planned to complete producing and delivering new subway cars for L.A. Metro’s Red and Purple lines over later years. But, like expansive contracts in other United States cities, federal regulators have concerns. The company is developing and overseeing critical passenger rail technology.

CRRC MA had to conduct comprehensive cybersecurity audits at its Chinese and American facilities. Only after this, they received approval for the L.A. Metro contract. Indications suggest the deal may face provisional restrictions. These may involve CRRC’s access to rider data, maintenance plans, and control over car operating systems. Encryption requirements could further complicate software integration.

In August 2023—more than six years after the contract award—L.A. Metro received the first of its new subway cars from CRRC MA.

As of the writing of this essay, the CRRC MA’s website has not changed to reflect reality:

In December 2016, the Los Angeles County Metropolitan Transportation Authority’s (Metro) awarded a contract to CRRC MA to design and manufacture 64 new subway cars for the Red and Purple Lines with a consideration for an additional 218 subway cars totaling $647m. CRRC had the overall best value proposal, with the highest rated technical offer and lowest price. CRRC MA in partnership with Metro will focus on workforce development via this procurement to stimulate job creation and competitive wages and benefits. Delivery of the first pilot car is spring 2020 with the entire order of 64 slated for September 2021.

Massachusetts Bay Transportation Authority

Massachusetts Department of Transportation (MBTA) awarded CRRC MA a $840 million contract in 2014. They will manufacture new subway cars for the MBTA’s Red and Orange Lines—the contract aimed to deliver over 400 railcars from Springfield between 2018 and 2022. MBTA expected these new vehicles would modernize the aging MBTA fleet and enhance service quality.

But, the partnership between the MBTA and CRRC MA encountered challenges from the outset. Production delays arose due to technical issues. That resulted from manufacturing inexperience and difficulties in meeting American transit standards. Problems like faulty frame welding and propulsion system issues caused setbacks. Challenges aligning steps and doors with platform heights also led to setbacks. The onset of the COVID-19 pandemic in 2020 worsened the situation. It caused further delays due to disruptions in the supply chain and a slowdown at CRRC MA’s Springfield factory.

By late 2022, the MBTA had only received approximately 20 percent of the new railcars. The delays have been frustrating for MBTA officials and Massachusetts politicians. They expected economic benefits for the state and a revitalization of Springfield through the CRRC MA contract. The delays meant a prolonged wait for passengers. The subway fleet will have more spacious interiors. It will also have more oversized doors, improved seating, and enhanced accessibility.

As of March 2023, CRRC MA delivered 90 of the 404 new cars. Several of them had issues, including a battery explosion, a derailment, loose brake bolts, and faulty wiring. The defective wiring arced and struck a nearby train. Both parties strive to re-establish the partnership on solid ground. Massachusetts riders continue to await the arrival of the promised new cars, a commitment made years ago.

As of the writing of this essay, the CRRC MA’s website has not changed to reflect reality:

MBTA Orange line rail car production at CRRC MA’s manufacturing facility marked a major milestone at August 2019 with the introduction of the transit system’s 1st 6-car train set into revenue. One month later, customers welcomed the second brand new Orange Line train to the MBTA’s fleet.

Southeastern Pennsylvania Transportation Authority

In 2017, the Southeastern Pennsylvania Transportation Authority (SEPTA) awarded a $137.5 million contract to CRRC MA. They will manufacture 45 double-decker railcars for its regional commuter rail lines. SEPTA hoped the new “Silverliner VI” cars would upgrade capacity and the rider experience. Like the MBTA project, they aimed to do this through improved design and features. CRRC MA’s price was too reasonable a bargain to resist. SEPTA expected the double-decker “Electric Multiple Unit” fleet to arrive in 2022.2

Yet, SEPTA encountered its production setbacks with CRRC MA in the ensuing years. Faulty parts and components plague the order. CRRC MA had to halt manufacturing. That was due to issues with the HVAC system, high-voltage cabinet, shock absorbers, and passenger doors. They needed to regroup and fix problems.

The Springfield factory output got delayed further. Furthermore, Chinese-made CRRC MA components needed to integrate better with American requirements. These issues affected both hardware and software. CRRC MA built only two pilot cars while working through technical problems and red tape. At one point in 2022, CRRC MA reworked staircases between the lower and upper levels of SEPTA’s cars. That was because the clearance was too low, and many passengers would hit their heads on a panel.

COVID-related supply chain issues and labor shortages have worsened SEPTA’s railcar delivery delays from CRRC MA. The delays also affect other orders with transit agencies.

The first two cars are test vehicles for SEPTA. They arrived in Los Angeles after being shipped from Tangshan, China. They assembled and tested them there. Before shipping, they disassembled the cars. Then, CRRC MA moved them to Springfield, where they remain today. The remaining 43 cars will have CRRC’s China plant stainless steel shells. Then, workers outfit and assemble them at the Springfield factory.

There is no sign of when SEPTA will have its full 45 railcars. Adapting Chinese rail manufacturing expertise to United States standards has been difficult. Faulty components, pandemic-related slowdowns, data vulnerabilities, and testing failures have prolonged the wait. SEPTA continues to collaborate with the Chinese state-owned contractor. It hopes to revamp its regional rail fleet for the 220,000 daily riders.

The federal DOT inspector general office looked at the Federal Transit Administration (FTA) oversight of the SEPTA’s order. The Inspector General has concerns. They are about the certification that CRRC complies with “Buy America” requirements. FTA’s Buy America requirements mandate United States domestic components. The components and subcomponents for rolling stock produced in the United States must make up more than 70 percent.

As of the writing of this essay, the CRRC’s website has not changed to reflect reality:

CRRC MA completed design and is underway with manufacturing 45 double deck passenger cars for Southeastern Pennsylvania Transportation Authority (SEPTA). These vehicles and all future North American rail car contracts will be assembled in Springfield, Massachusetts with the first coach expected for delivery by the end 2020.

Analysis

The fate of these “deals” seems uncertain. CRRC’s ability to secure other transit contracts in the United States also appears debatable. That is because the economic relationship between America and China is fluctuating. The execution of these contracts has faced setbacks and uncertainties. Adding to the delay are escalating tensions between the United States and China. In 2024 and beyond, the orders will reveal if these partnerships work. It will determine if overseas state-affiliated rail firms can overcome new policy barriers.

Along the way, these deals have become embroiled in tensions between the United States and China. The pressures are over trade issues and national security. American officials and rival companies have a legitimate concern. They worry that CRRC’s government ownership lets it underbid competitors for public contracts. They do this by setting artificially low prices.

The problematic rollout also prompted security concerns. They were about the access of the Chinese-owned CRRC two subsidies in the USA. That includes infrastructure details within American rail systems. Some lawmakers expressed worries about granting Chinese state-affiliated companies access to railway systems. These systems are responsible for transporting government officials and employees. Sluggish railcar deliveries and cybersecurity risks have cast doubt on CRRC’s future business prospects in the United States.

Also, cybersecurity concerns authorities as they need help integrating Chinese rail systems into American rail transit. That fuels data vulnerabilities. United States policymakers voiced concerns over data theft and critical infrastructure sabotage. Riders are eager for upgrades to America’s most prominent public transit systems.

Nonetheless, CRRC’s domestic operations represent a caustic evolving dynamic. China and the United States cooperate across industries and supply chains while competing in the global economy. The future of the railcar plants in Springfield, Massachusetts, and Chicago, Illinois, hangs in the balance. It will help determine whether this complex relationship continues progressing in the years ahead. That will affect strategic sectors.

Years before the $30 billion for high-speed rail showered out in 2023, the federal government provided most of the funds for these projects. The combined cost of the four above-described deals totals $2.9 billion.

Frederick R. Smith’s essays, Tainted Railroad Honey Pot and Giant Government Gravy Train, depict a grim picture. These essays highlight the reasons why the United States is seen as a source of embarrassment in comparison to the rest of the developed world when it comes to passenger trains.

A Sad Commentary

As noted in my essay Tainted Railroad Honey Pot, domestically-owned passenger railcar manufacturing is a relic of the past. As a vestigial remnant, some small-scale, domestically owned operations exist. These facilities make equipment for specialty applications such as tourist railways. Frustratingly, four foreign-owned businesses today make passenger railcars for the USA market.

The United States desperately needs domestically owned passenger railcar makers. That casts a somber shadow over the nation’s transportation landscape. American passenger railcar manufacturing was once a thriving industry with a rich history. It has declined. This decline reflects a narrative of lost opportunities and economic shifts. It also reflects a dwindling commitment to sustainable and efficient transportation.

In the heyday of rail travel, iconic American companies like American Car & Foundry, Bethlehem Steel, J. G. Brill, Budd Company, General Electric, Pullman, and St. Loius Car Company played instrumental roles. They shaped the passenger rail experience. As the 20th century progressed, the rise of the automobile and the expansion of air travel harmed rail. It reduced the importance of passenger rail transportation. This shift in preference has reduced the demand for domestic passenger railcar manufacturing. The challenges of maintaining aging infrastructure have also contributed to this decline.

This decline has multifaceted and disheartening consequences. Outsourcing railcar production to foreign manufacturers impacts the domestic job market. It also erodes the self-reliance that once defined American industry. Other nations invest in high-speed rail and modernize their rail networks. The United States needs to catch up, and sadly, it depends on external sources for the vehicles.

The lack of a robust domestic passenger railcar industry presents challenges. We need adaptability and innovation. Foreign manufacturers only sometimes consider the specific needs of the American rail system. They might need to account for its intricacies. This lack of alignment affects the efficiency of rail travel. It also diminishes the potential for technological advancements. These advancements could enhance safety, comfort, and environmental sustainability.

Moreover, losing a domestic passenger railcar industry carries a cultural weight. It signifies a departure from an era. The rhythmic clickety-clack of train wheels was synonymous with American progress and connectivity. The landscapes had bustling passenger rail yards and the ingenuity of American engineering. Now, they rely on imported railcars. That contributes to a sense of detachment from a once-proud legacy.

The need for a thriving domestic passenger railcar manufacturing industry reflects missed opportunities. The revival of such an industry would not only serve as an economic stimulant. It would also rekindle a sense of pride in American craftsmanship and innovation. Until then, the melancholy echo of an industry’s decline resonates through the empty spaces. Fully American-made passenger railcars once rolled there.

Welcome to the New World Order.

Conclusion

In conclusion, exploring CRRC’s ventures in the United States reveals a complex landscape. The company has contracts with the Chicago Transit Authority (CTA), Los Angeles County Metropolitan Transportation Authority (L.A. Metro), Massachusetts Bay Transportation Authority (MBTA), and Southeastern Pennsylvania Transportation Authority (SEPTA). Economic, geopolitical, and technical challenges shape this landscape.

The $1.3 billion CTA railcar order marked a significant expansion for CRRC in the United States public transportation sector. Yet, it faced obstacles such as tariffs. It also faced cybersecurity concerns and increased scrutiny under the Biden administration. The delays and cybersecurity issues with the 7000-series order show the challenges. That focuses on international collaborations in sensitive industries.

Officials valued the L.A. Metro contract at $647 million. The project experienced prolonged delays. It also underwent cybersecurity audits, and the delivery occurred six years after the award. That highlights the regulatory hurdles and security considerations associated with contracts involving CRRC.

The MBTA contract is worth $840 million. It faced many challenges. These included technical issues, manufacturing delays, and disruptions due to COVID-19. The delays and technical problems have frustrated officials. They have also raised concerns about the partnership’s ability to deliver on its promises.

SEPTA’s $137.5 million contract with CRRC MA faced production setbacks. It also faced faulty components and cybersecurity concerns. These issues contributed to delays in receiving the railcars. The collaboration with a Chinese state-affiliated company led to scrutiny from policymakers. That reflects broader concerns about data vulnerabilities and national security.

These contracts all share a common thread. It is the interplay between economic cooperation and geopolitical tensions. CRRC faces challenges. It shows the delicate balance between fostering international partnerships and safeguarding national interests. The financial relationship between the United States and China fluctuates. Concerns about data security and technology transfer add complexity to these ventures.

The contracts will progress through 2024 and beyond. The outcomes will provide insights into the resilience of partnerships with state-affiliated firms. They will show how well these partnerships can adapt to changing policy barriers. The success or failure of CRRC’s efforts in the United States will likely shape collaboration and competition between China and strategic sectors. It could offer lessons for the future of international business in sensitive industries.

The projects in total cost $2.9 billion. Most funding came from the federal level. These efforts show the need for careful consideration of challenges and risks. That is especially important in large-scale international collaborations in critical infrastructure development.

Parting Shot

We all see the label “Made in China” on most consumer goods. The moniker “Engineered in USA made in China” is an insult, too. The next phase might be “Made in USA by China.” Enjoying the ride, railroaded, that is? 📕

Sources

China Railway Rolling Stock Corporation

Transit Authorities

News & Other Sources

7000-series Cars ~ Chicago-L.org

Addressing the Threat From Securities Investments That Finance Certain Companies of the People’s Republic of China ~ Federal Register ~ June 7, 2021

CRRC Delivers New Chicago Metro Trains ~ Railway News ~ June 23, 2022

LA receives new subway cars ~ Trains.com ~ August 18, 2023

Fiasco: MBTA’s contract with CRRC ~ Rail Security Alliance

SEPTA’s new railcars plagued by faulty wiring, repeated delays ~ Philadelphia Inquirer ~ March 2, 2023

New SEPTA cars from CRRC to be delayed ~ Trains.com ~ July 1, 2019

With more delays for new equipment, MBTA puts Band-Aids on old trains ~ HORIZONMASS ~ November 27, 2023

Experts to scrutinize Springfield plant building MBTA train cars after delays ~ February 2, 2023 ~ MassLive

Audit Initiated of FTA’s Oversight of SEPTA’s Compliance With Buy America Requirements for Rolling Stock ~ US DOT Office of Inspector General ~ February 24, 2023

The T’s New Train Factory Has Gone Off the Rails ~ February 3, 2023 ~ StreetsblogMASS

CRRC won’t be able to meet schedule calling for three-year-late delivery of MBTA cars ~ Trains.com ~ January 26, 2023

CRRC may face new US sanctions ~ rollingstockworld.com ~ October 11, 2022

I warmly encourage you to consider becoming a paid subscriber if you have the means. Regardless of your choice, your support is deeply appreciated. From the bottom of my heart, thank you for your invaluable support!

Located on CRRC Sifang’s website: House Armed Services Chairman Adam Smith on Wednesday said he’s skeptical about whether national security is really at risk when it comes to Chinese buses and rail cars, saying banning them is a ploy by U.S. manufacturers “to eliminate the competition.”

An Electric Multiple Unit (EMU) train is a self-propelled train consisting of cars that use electricity as the motive power. The train does not require a separate locomotive, as electric traction motors get built into one or a number of the cars. Two or more semi-permanently coupled cars constitute an EMU, but electrically powered single-unit railcars are also generally called EMUs. Due to their fast acceleration, EMUs are popular on commuter and suburban rail networks worldwide.

Black Swan event can be anything

https://www.zerohedge.com/political/cbs-news-reporter-makes-dark-prediction-black-swan-event-2024

Shocking, I did not know any of this!

Globalization (Chinafacation) will be the death of us all, if not slavery.